2022/23 Federal Budget – Other budget announcements

Extending the reduction in minimum drawdowns

The Government will extend the 50% reduction of superannuation minimum drawdown requirements for account-based pensions (‘ABPs’) and similar products for a further year to 30 June 2023 (i.e., for the 2023 income year).

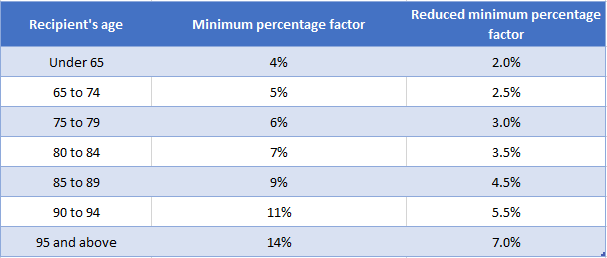

Based on this change, the (effective) reduced minimum percentage factors for ABPs (including TRISs), which are used to calculate the minimum annual pension amount under Schedule 7 to the SIS Regulations, are set out in the following table for the 2023 income year.

Note that, for ABPs and TRISs that commence or cease part-way through the 2023 income year, a pro-rated minimum pension payment applies (unless the pension commenced on or after 1 June

2023, in which case, no minimum pension payment is required).

Varying the GDP uplift factor for tax instalments

The Government has decided to set the GDP uplift factor for PAYG and GST instalments at 2% for the 2023 income year. This uplift factor is lower than the 10% that would have applied under the statutory formula.

The lower uplift rate will provide cash flow support to small businesses, including sole traders and other individuals with investment income.

The 2% GDP uplift rate will apply to small to medium enterprises eligible to use the relevant instalment methods (i.e., up to $10 million annual aggregated turnover for GST instalments and $50 million annual aggregated turnover for PAYG instalments) in respect of instalments that relate to the 2023 income year and fall due after the enabling legislation receives Royal Assent.

Digitalising trust income reporting and processing

The Government will digitise trust and beneficiary income reporting and processing by allowing all trust return filers the option to lodge income tax returns electronically, increasing pre-filling and automating ATO assurance processes.

This measure acknowledges that trust income reporting has not been automated to the same extent as individual and company tax returns. This measure will reduce the compliance burden,

reduce processing times, and enhance ATO processes.

This measure is proposed to commence from 1 July 2024, subject to advice from software providers about their capacity to deliver.

Expanding access to employee share schemes

The Government will expand access to employee share schemes and further reduce red tape so that employees of all levels can directly share in the business growth they help to generate.

Where employers make larger offers in connection with employee share schemes in unlisted companies, participants can invest up to the following amounts (thereby allowing employers to access simplified disclosure requirements and exemptions from licensing):

- $30,000 per participant per year (which is an increase from $5,000), accruable for unexercised options for up to five years, plus 70% of dividend and cash bonuses;

- or any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

The Government will also remove regulatory requirements for offers to independent contractors, where they do not have to pay for their interests.

Cost of living payment

The Government will provide a one-off $250 cost of living payment to help eligible recipients with higher cost of living pressures. The payment will be made in April 2022 to eligible recipients

of the following payments and to concession cardholders:

- Age Pension.

- Disability Support Pension.

- Parenting Payment.

- Carer Payment.

- Carer Allowance (if not in receipt of a primary income support payment).

- Jobseeker Payment.

- Youth Allowance.

- Austudy and Abstudy Living Allowance.

- Double Orphan Pension.

- Special Benefit.

- Farm Household Allowance.

- Pensioner Concession Card holders.

- Commonwealth Seniors Health Card holders.

- Eligible Veterans’ Affairs payment recipients and Veteran Gold cardholders.

The payments are exempt from tax and will not count as income support for the purposes of any income support payment. A person can only receive one economic support payment, even if they are eligible under two or more categories outlined above.

The payment will only be available to Australian residents.

Temporary reduction in fuel excise

The Government will help reduce the burden of higher fuel prices by halving the excise and excise-equivalent customs duty rate that applies to petrol and diesel, and all other fuel and petroleum-based products except aviation fuels, for six months. This measure will commence from 12.01am on 30 March 2022 and will remain in place for six months.